Setting a new second-quarter record in the Q2 2019, the smartphone shipments in India grew to 37 million units with Xiaomi retaining its top...

Setting a new second-quarter record in the Q2 2019, the smartphone shipments in India grew to 37 million units with Xiaomi retaining its top spot (28 percent market share), a new report has said. According to the latest research from Counterpoint’s Market Monitor service, the growth was driven by new launches, price cuts on older devices and channel expansion across brands. The market research firm also said that people in the country are now looking to buy phones that range from Rs 10,000 to Rs 20,000.

“Brands which focused on offline channels expanded to online channels with online-exclusive series. Similarly, brands which entered the market with online-exclusive series are now expanding their reach towards offline channel by forming partnerships with key offline retailers. This strategy is working well for all the leading at-scale players. Also, brands are launching multiple series to target or expand into new product tiers. This is helping them to expand their product portfolio to target multiple fast-growing segments and also diversify,” Tarun Pathak, Associate Director, said in a statement.

“In India, the pricing sweet-spot for consumers has moved to Rs 10,000-20,000 price band and it will remain the biggest contributor in the Indian smartphone segment this year. Brands are focusing on bringing the latest premium level specifications such as notch display, full-screen view, multiple rear cameras, pop up selfie feature and in-display sensor technology in this segment to stimulate consumer demand,” he added.

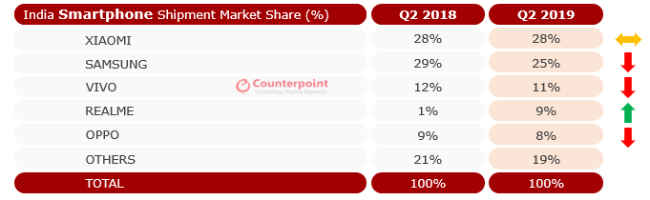

Brandwise segregation

Xiaomi captured the top spot in this quarter with a 28 percent market share. Its shipments grew 6 percent (YoY) driven by portfolio expansion, and offline expansion in the budget segment. Samsung shipments declined by 7 percent YoY, but, it has shown 30 percent growth quarter-over-quarter (QoQ) driven by refreshed A-Series and M-Series, price cuts of older J-Series and higher channel incentives during IPL season.

Samsung’s A-series remained popular with Galaxy A10 being the top-selling device for the South Korean brand. The brand also expanded the M-series with launch of Galaxy M40 in June. Samsung remained strong in the premium segment with good performance of its Galaxy S10 series flagships.

Oppo and Vivo increased their offline channel incentives on their entry to mid-level devices to drive volumes. These devices were coupled with promotions for IPL and Cricket World Cup events. Vivo’s shipments remained almost flat YoY, however, its performance remained strong in less than Rs 10,000 price band due to Y91 series. Oppo’s shipments declined 3 percent YoY, however, it showed 53 percent QoQ growth due to new launches.

This is the third consecutive quarter that Realme has been within the top 5 brands driven by strong performance of Realme C2 and Realme 3 Pro and various discount offers rolled out on online platforms. Realme C2 crossed the 1 million mark within a couple of months of launch, and became the fastest brand to reach 8 million smartphone shipments in India market within one year of its debut for any brand ever in India.

Huawei’s trade ban also impacted India market as its shipments declined YoY. However, the brand continues to be in the top ten smartphone brands category. In the premium segment, OnePlus surpassed Samsung to become the number one player driven by strong demand for its newly-launched OnePlus 7 series.

“The top five brands’ contribution to the total shipments volume reached its highest ever level driven by new launches and hybrid channel strategy. Localisation, branding, and innovation will remain to be the next key drivers for growth in a highly competitive market like India. The market will continue to become more concentrated with majority of share controlled by a few brands leading to more number of exits among the long-tail brands in the market moving forward,” Anshika Jain, Research Analyst at Counterpoint Research, added.

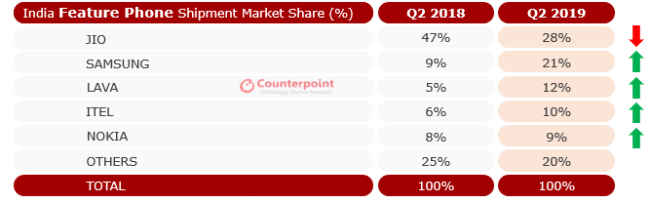

While the smartphone market registered growth YoY, the feature phone market witnessed a steep decline of about 39 percent annually. The feature phone demand is back to 2017 (pre-Jiophone) level but it remains to be seen if the entry-level smartphones in coming quarters are able to attract the hundreds of millions of feature phone users. Due to the slowing demand for Jiophone, players such as Samsung, Lava and iTel were able to capture shares in sub-Rs 1000 segment during the quarter.

from Latest Technology News https://ift.tt/2LJxovl

COMMENTS